Get in touch 0117 325 0526

Get in touch 0117 325 0526

We updated you in our July and August Newsletter Coronavirus (COVID-19): All things furlough – (again!) that the Government started to phase out the Coronavirus Job Retention Scheme (CJRS) from 1 August 2020.

The CJRS ends on 31 October 2020 and, as a reminder, here’s the timetable of increasing employer contributions up to that date:

| Date | % recoverable wages | Additional employer liabilities |

| 1 August | 80% unworked days (up to £2,500) | Employer National Insurance (NI) and pension contributions |

| 1 September | 70% unworked days (up to £2,187.50) | Employer NI and pension contributions & 10% wage contribution (to make up the 80% total up to a cap of £2,500 i.e. up to £312.50) |

| 1 October | 60% unworked days (up to £1,875) | Employer NI and pension contributions & 20% wage contribution (to make up the 80% total up to a cap of £2,500 i.e. up to £625) |

| 1 November onwards | No further Government subsidy payable under CJRS | Employer liable for 100% wages, or use the Government’s Job Support Scheme (see further details below) |

The end of the CJRS on 31 October 2020 is now days away and many employers are no doubt busy preparing for this. Employers’ options include:

An early and open discussion with employees about returning to the workplace is recommended as this will help manage any issues at an early stage (such as childcare issues or health and safety concerns).

However, there are no proscribed measures about how to bring employees’ furlough leave to an end. Ending an employee’s leave will largely depend on the employer’s terms of their furlough leave, for example, whether it involved a temporary change to employment terms.

If employees are simply returning to their pre-furlough employment contract, with no changes, notice of the return date can be given verbally. However, we would recommend also confirming this in writing. If any terms and conditions were amended by the furlough agreement, then further agreement may be needed to revert back to the pre-furlough position.

If an employer needs to make changes to the employee’s role on their return to the workplace, then they are likely to need to agree these changes with employees (see our comments on changing terms and conditions in our June Newsletter Coronavirus (COVID-19): Returning to the workplace).

Employers could consider requiring their employees to take all or part of their annual leave; provided that their employment contracts allow for this. Employers must generally give employees at least twice as many days’ notice as the number of days’ annual leave they are being required to take (e.g. ten days’ notice for five days’ annual leave). This should be in writing and, where possible, specify the relevant dates.

From 1 November 2020 until its current end date on 30 April 2021, eligible employers will be able to access the Government’s new financial package, the “Job Support Scheme” (JSS). The Government’s fact-sheet on this new scheme is available here, and further guidance and information on the JSS is expected to follow.

The JSS is aimed at protecting viable jobs in businesses which are currently facing lower demand than normal. The aim is to keep people in the workforce, even if they cannot work their usual hours.

Similar to its predecessor, ‘flexible furlough’, the employer is expected to pay its employees for time worked. However, the burden of paying for hours not worked will be split between the employer and the Government, with the employee also contributing by a salary reduction.

Eligibility: All small and medium enterprises (SME) will be eligible to access the JSS automatically, without the need for a financial assessment test. In the UK, an SME is usually defined as a company which meet two out of three of the following – turnover of less than £25m, fewer than 250 employees, and gross assets of less than £12.5m.

Large businesses will only be eligible if they are able to show that their turnover has been adversely affected by COVID-19. This will be assessed by a financial test. Even if a large employer meets this test, the expectation is that they will not use the JSS if they make any capital distributions (e.g. dividend payments) while accessing the grant.

Employees must be on an employer’s PAYE payroll on or before 23 September 2020. This means a Real Time Information (RTI) submission to HMRC (notifying payment to that employee) must have been made on or before this date.

Importantly, unlike the CJRS, employees cannot be made redundant or put on notice of redundancy during the period for which the employer is claiming a grant for that employee. What is not clear is whether that refers to the whole six months of the JSS or a particular pay period – something which will hopefully be covered in further guidance.

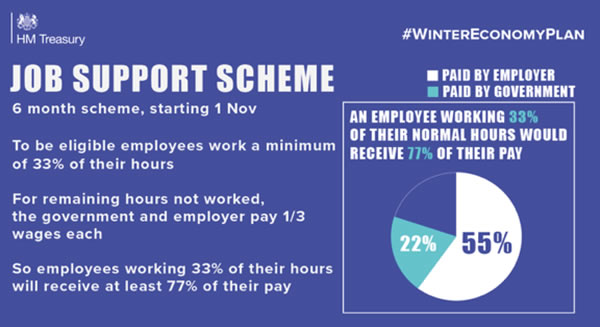

Payments: For the first three months of the JSS, until 31 January 2021 the employee must work at least 33% of their usual hours in order to qualify for Government funding for their remaining hours. After three months, the Government will consider whether to increase this minimum hour’s threshold.

The employer is expected to pay the employee their full usual wages for those hours worked. Employees who have previously been furloughed will have their underlying usual pay and/or hours used to calculate usual wages, not the amount they were paid whilst on furlough.

For every hour not worked, the employer and the Government will each pay one third of the employee’s usual pay, but the Government contribution will be capped at £697.92 per month. The grant will not cover Class 1 employer NICs or pension contributions, although these contributions will remain payable by the employer.

Since the maximum hours an employee won’t work is 67%, this means that the maximum Government contribution will be 22%. This will reduce on a sliding scale the more hours an employee actually works. This means that employees using the scheme will receive at least 77% of their pay, where the Government contribution has not been capped:

Employers will be able to make a claim online through GOV.UK from December 2020 and will be reimbursed in arrears.

Other requirements: Employers must agree the new short-time working arrangements with their staff, make any changes to the employment contract by agreement, and notify the employee in writing. This agreement must be made available to HMRC on request. This appears to be similar to the rules regarding the CJRS.

Employees will be able to move on and off the scheme and do not have to be working the same pattern each month, but each short-time working arrangement must cover a minimum period of seven days.

HMRC will check claims. Payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information. Grants can only be used as reimbursement for wage costs actually incurred.

Employers using the JSS will also be able to claim the Job Retention Bonus (see below) if they qualify for it.

We will update you on more details of the JSS as they become available.

Employers will be entitled to a one-off bonus payment (of £1,000) for every employee that had been on furlough but remains in employment (and is not serving their notice) until 1 February 2021, subject to their earning at least £1,560 from 1 November 2020 to 31 January 2021. We are currently waiting for more guidance from the Government on this scheme but in the meantime for further detail see our September Newsletter here.

For employers who are not eligible for the JSS (see above) or for whom it may not be suitable, it maybe possible to keep employees on their own furlough scheme, with reduced terms, when the CJRS ends, provided employees agree. Employers would need a new or extended furlough agreement with employees (depending on how the terms of the existing agreement have been framed). This could reduce pay below 80%, or even implement furlough on no pay. Employees may be willing to agree to this as an alternative to redundancy. However, if the plans involve more than 20 staff, and the intention would be to dismiss the employees if they do not agree, then collective consultation duties may be triggered and employers should consult on the changes with employee representatives over 30 days (where between 20 and 99 dismissals are proposed) or 45 days (where 100 or more dismissals are proposed.

As a temporary solution to a reduction in work, employers may have the right to “lay-off” staff. This provides employers with a right to send people home (for no pay) for a short period of time, where the employee expressly consents to this or if there is an express or implied right in employees’ employment contracts or collective agreements to do so. However, the employees may be entitled to a daily statutory guarantee payment for up to five days in any three-month period, if certain criteria are met (including the employee having one month’s continuous employment). The maximum daily guarantee payment is £30 (from 6 April 2020). If a Lay-off period continues for four consecutive weeks or six weeks within a period of 13 weeks, employees may be entitled to claim statutory redundancy pay.

Alternatively, where the employee expressly consents or where there is an express or implied contractual right to do so, an employer may have the right to put employees on “short-time” working. This is when an employee works reduced hours or is paid less than half a week’s pay. For days when the employee is provided with no work, they may be entitled to a statutory guarantee payment as set out above. If a Short-time Working period continues for four consecutive weeks or six weeks within a period of 13 weeks employees may be entitled to claim statutory redundancy pay.

If you do wish to use lay-off or short-time working we recommend you seek legal advice on this as the process and detail of these schemes are complex.

Employers may decide that they have no choice but to make employees redundant where there is no work available, or a reduced need for a particular kind of work, or where a business is shut down.

If an employer proposes to dismiss 20 or more employees ‘at one establishment’ in a 90-day period for redundancy (or changes to terms and conditions) then collective consultation is required, which means consulting with employee representatives over 30 days (where between 20 and 99 dismissals are proposed) or 45 days (where 100 or more dismissals are proposed). If more than 20 redundancies are proposed, employers must file an HR1 form with the Secretary of State (see our September Newsletter here).

If fewer than 20 redundancies are anticipated, only individual consultation is required. Although there are no prescribed timescales for this period, employers need to follow a fair and reasonable procedure in order to avoid unfair dismissal claims (for those with over two years’ service). Consultation with individual employees is fundamental to the fairness of a dismissal for redundancy. The shorter the period of consultation, the more likely it is to lead to a finding of unfair dismissal. Consultation must be genuine, with the employee being given adequate time and information to respond and the employer considering any response properly. Given that consultation will be more complex and time-consuming during COVID-19 (if the affected employees are furloughed or working from home), it is likely that at least a two week consultation period would be necessary before giving notice.

Employers should consider voluntary redundancy and ensure that they provide adequate notice or payment in lieu of notice where applicable.

Statutory notice pay and redundancy payments (for those employees with over two years’ service) should be based on an employee’s normal pay, rather than their reduced furlough pay. For further detail see our September Newsletter here.

Tags: coronavirus, COVID-19, Furlough, job retention bonus, job support scheme

Categories: Employment Law

5.0/5